Debt review removal involves an emotional journey from anxiety to empowerment and beyond.

Choosing the Right Debt Counsellor for Removal

Choosing the right debt counselor is crucial for a successful and smooth debt review removal.

Expert Advice on Debt Review Removal

Expert advice can guide you through the nuances of debt review removal for a more prosperous future.

Success Stories: Life After Debt Review Removal

Real-life success stories showcase the transformative power of debt review removal.

Financial Planning After Debt Review Removal

Post-debt review financial planning involves setting up for a stable financial future.

The Impact of Debt Review Removal on Credit Score

Removing debt review can significantly affect your credit score, offering both immediate and long-term benefits.

Common Myths About Debt Review Removal

Debunking myths is essential for understanding the true nature of debt review removal.

Legal Aspects of Debt Review Removal

The legal side of debt review removal involves understanding the National Credit Act and its implications.

Understanding Debt Review Removal

Debt review removal can be a beacon of hope for those looking to regain financial independence.

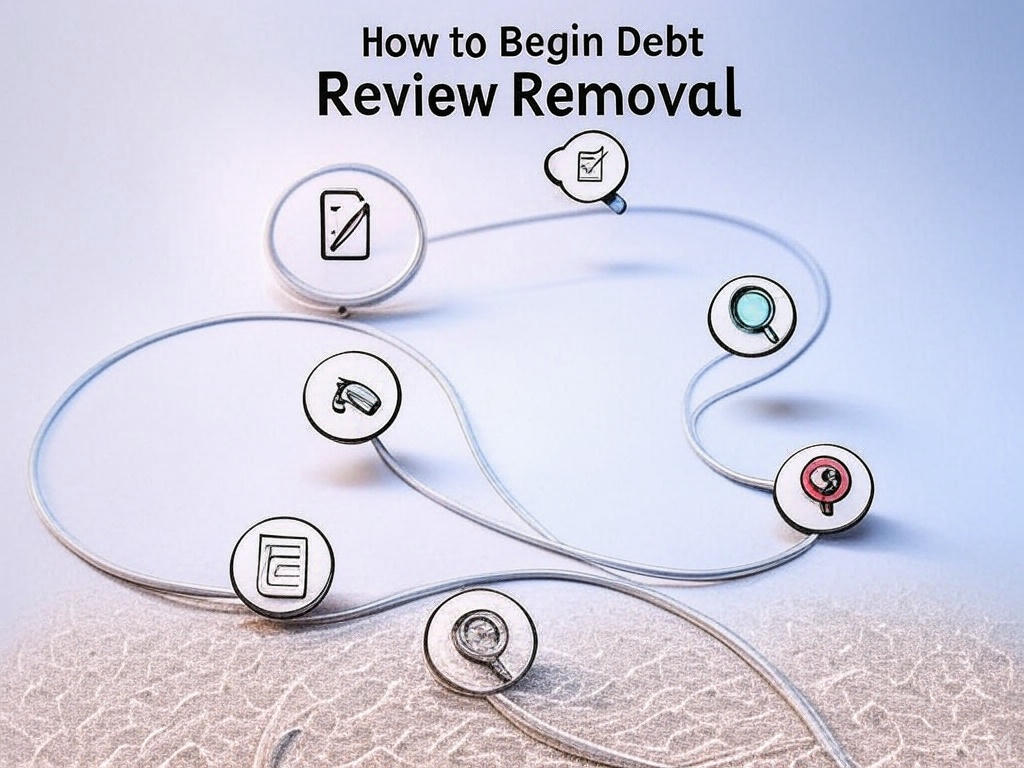

How to Begin Debt Review Removal

Embarking on the path to debt review removal is akin to starting a new chapter in your financial story. Here’s a detailed guide on how to initiate this process:

**Step 1: Confirm Payment Completion**

First, ensure that all payments under your debt review plan are up to date. This means verifying with your debt counselor that you’ve fulfilled all payment obligations as per your agreement.

**Step 2: Collect Clearance Certificates**

Each creditor involved in your debt review must issue a clearance certificate once your debt is settled with them. These certificates are proof that you’ve cleared your debt with each party, and they are vital for the removal process.

**Step 3: Engage Your Debt Counsellor**

Your debt counselor plays a pivotal role. They should help you compile all necessary documentation, including clearance certificates, and assist in the application for removal at the National Credit Regulator or through the court if necessary.

**Step 4: Application for Removal**

This involves submitting an application to the NCR or a court, depending on local regulations. Your debt counselor should guide you through this, ensuring all paperwork is correctly filled out and all legal steps are followed.

**Step 5: Wait for Confirmation**

After application, there’s a waiting period while your case is processed. This can be nerve-wracking, but patience is key. Once approved, your credit report will be updated to reflect that you are no longer under debt review.

**Step 6: Monitor Your Credit Report**

Post-removal, it’s essential to keep an eye on your credit report to ensure the removal has been correctly recorded. Any discrepancies should be challenged immediately.

This journey requires meticulous planning, patience, and a proactive approach to your financial recovery. Remember, starting this process is more than an administrative task; it’s about setting the foundation for a financially stable future.

The Emotional Journey of Debt Review Removal

Debt review removal involves an emotional journey from anxiety to empowerment and beyond.

Choosing the Right Debt Counsellor for Removal

Choosing the right debt counselor is crucial for a successful and smooth debt review removal.

Expert Advice on Debt Review Removal

Expert advice can guide you through the nuances of debt review removal for a more prosperous future.

Success Stories: Life After Debt Review Removal

Real-life success stories showcase the transformative power of debt review removal.

Financial Planning After Debt Review Removal

Post-debt review financial planning involves setting up for a stable financial future.

The Impact of Debt Review Removal on Credit Score

Removing debt review can significantly affect your credit score, offering both immediate and long-term benefits.

Common Myths About Debt Review Removal

Debunking myths is essential for understanding the true nature of debt review removal.

Legal Aspects of Debt Review Removal

The legal side of debt review removal involves understanding the National Credit Act and its implications.

Understanding Debt Review Removal

Debt review removal can be a beacon of hope for those looking to regain financial independence.